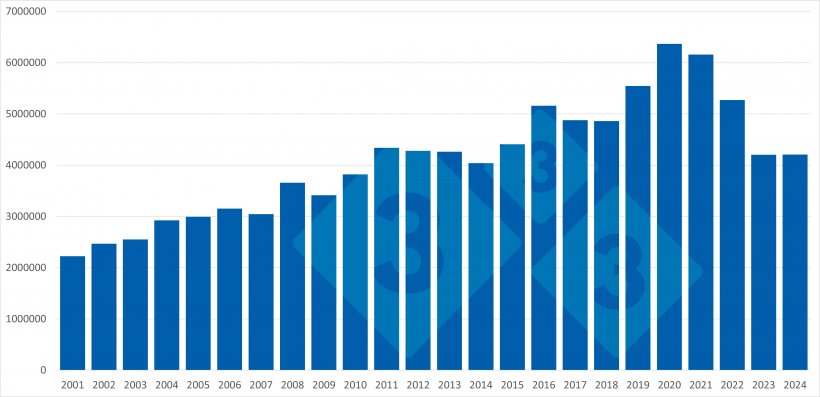

Total exports

Total exports of pork and pork products from the European Union to third countries in 2024 closed at 4.21 million tons, virtually unchanged from the 2023 figure (4.20 million t), but well below the all-time record reached in 2020, when 6.36 million tons were exported.

During the period 2001-2020, the sector's foreign trade trended upwards, with an increase of almost 300% in two decades, driven by Asian demand (especially from China) and the competitiveness of the European product. The most notable jump occurred between 2016 and 2020, in the midst of the African swine fever crisis in Asia, which made the EU a key supplier globally.

Since 2021, however, exports have entered a phase of sustained decline, accumulating a 33% drop in just four years. This contraction is partly due to the recovery of production in China and a more uncertain international context.

The EU's extra-EU exports of pork and pork products: 2013-2024. Source: 333 based on data from Pigmeat Trade Data.

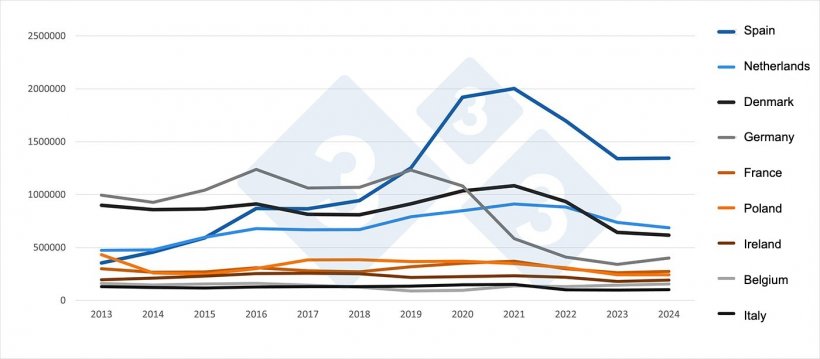

Spain, Denmark, and the Netherlands lead in exports

In 2024, Spain continued as the largest exporter of pork and pork products in the European Union, with more than 1.34 million tons exported to third countries, well ahead of the rest of the Member States.

The Netherlands positioned itself as the second-largest exporter in 2024, with 686 thousand tons, clearly surpassing Germany and Denmark.

Denmark, historically one of the main exporters, ranked third with 616 thousand tons. Germany remained in fourth place with 400 thousand tons despite an increase of almost 18% compared to 2023, a figure well below the more than 1.23 million it reached in 2019. This sharp drop since 2020 corresponds to the appearance of African swine fever (ASF) in the country for the first time, which led to the closure of markets such as China, South Korea, and Japan (major buyers of German pork).

France, with an increase of 4.8%, and Poland complete the middle group, with figures below 300 thousand tons, while Ireland and Belgium are below 200 thousand tons. Finally, Italy stood at 102 thousand tons, an increase of 5.7% over 2023.

Extra-EU pork exports by Member State (2013-2024). Source: 333 based on data from Pigmeat Trade Data.

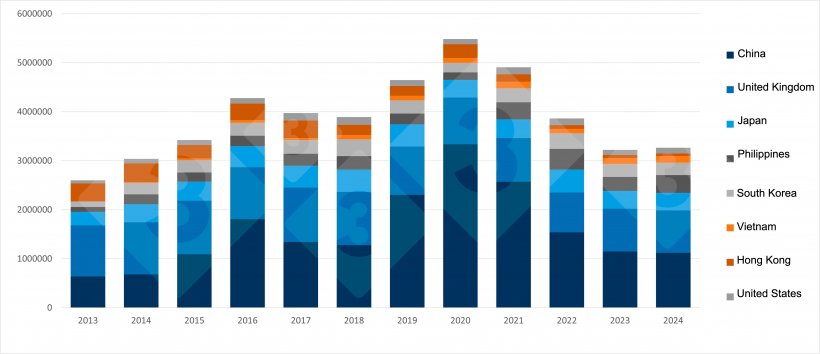

Main destinations

China continues to be the main destination for exports of pork and pork products from the European Union, with a total of 1,123,815 tons exported in 2024 and a slight reduction compared to 2023 (-2%). However, this figure represents a sharp drop of 56% compared to the peak reached in 2020, when 3,337,529 tons were exported to the country.

On the other hand, the United Kingdom remains the second largest destination, with 864,210 tons in 2024, although it has also experienced a gradual decline from its record of over 1 million tons in previous years (2017-2019). Despite Brexit, trade with the UK remains solid.

The Philippines ranked third in 2024, with 366,518 tons, surpassing Japan for the first time, which received 354,734 tons of European pork and pork products. South Korea, Vietnam, and the United States complete the list of top destinations with significant but lower volumes, while Hong Kong, which in 2013 and 2014 exceeded 350,000 tons, has reduced its share drastically to just 53,624 tons in 2024.

Annual evolution of key destinations for EU pork (2013-2024). Source: 333 based on data from Pigmeat Trade Data.

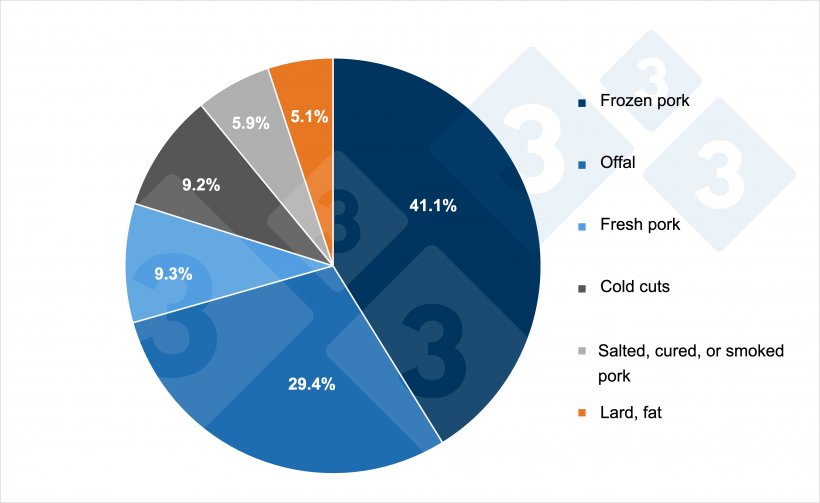

Main products exported

Frozen pork, which continues to be the main exported product with 1.73 million tons (41.1% of the total), suffered a decrease of 4.3% compared to the previous year.

On the other hand, offal exports grew by 6.8%, representing 29.4% of the total (1.24 million tons). This was followed by exports of fresh pork, which remained stable at 9.3% of the total (+0.3%), and cold cuts, which fell slightly (-0.6%) but maintained a share of 9.2%.

Salted, cured, and smoked pork decreased by 1% over the previous year, while fat and lard, with 5.1% of the total, increased by almost 5% over 2023.

The market continues to show a high concentration: the two main products - frozen meat and offal - account for more than 70% of the total exports.

Composition of European exports of pork and pork products by product type (2024). Source: 333 based on data from Pigmeat Trade Data.

May 14, 2025/ 333 Staff with data from Pigmeat Trade Data.